Volvin Philosophy - “Winning”

Winning through volatility beautifully sums up the entire Volvin Philosophy.

Clearly both “Winning” and “Volatility” are equally important & integral to the whole philosophy.

The Philosophy has both active and passive sides to it. As the philosophy requires use of both the Equity and Derivatives segment, the funds acts both as passive as well as active in their respective segments.

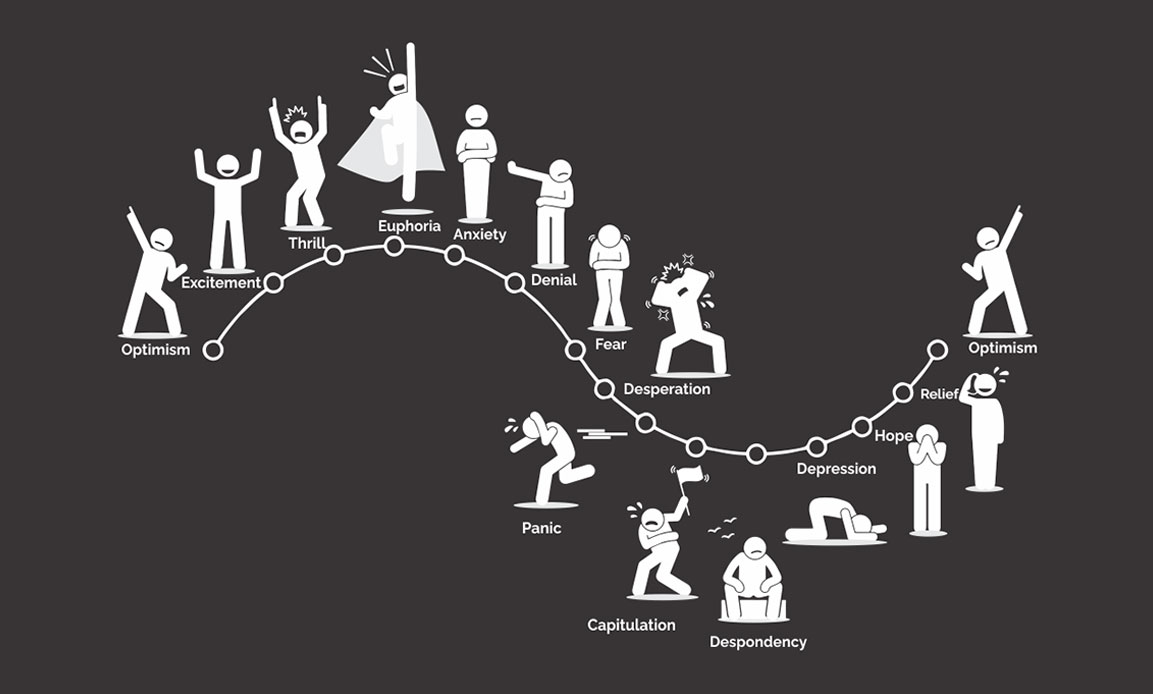

Volvin Philosophy is derived from the basic human nature of greed and fear. This is especially relevant to the domain we are working in – financial and capital markets.

At Volvin we believe that fundamental investing is the paramount factor for stock selection. The stocks are carefully picked keeping in mind the valuation, growth prospects & dividend yield. We are not comfortable in adding high PE stocks either from FMCG or the new age, ecommerce and fintech sectors. Most of the stocks in the FMCG sectors at 60-80 PE already seem to price for at least next 3-5 years future growth. Similarly the IoT sector seems to be pricing near zero failure rates for all the competing companies.

Human Psychology

Humans are known to seek thrill, sometimes bordering very close to fear. These thrill seekers will pay for the thrill or the fun they seek. We have these high adrenaline loving people in the amusement parks as roller coaster riders, in the casino as gamblers and in the stock market as speculators. These people help generate income by paying for the tickets, placing bets in the casino or buying options^ in the stock markets. Without them, the phrase, “The House Always Wins”, would not have originated as these thrill seekers are sine qua-non to the existence of the amusement park, casino or the stock markets.

The speculators or option buyers may have to pay a premium of approximately 2.5-5.0% per month for each stock they anticipate the upside or downside on. Volvin Strategy involves selling these options and collecting the premium or money for the same. The fund endeavours to create a monthly profit or “winning” by the premiums collected on the options sold on the underlying portfolio.

| Situation > | Roller Coasters | Casino | Stock Markets |

|---|---|---|---|

| Thrill Seekers | Riders | Gamblers | Speculators |

| Payment Made | Buys a ticket | Places Bets | Buys Call & Put Options |

| Profit Generation | Amusement Park | The House - Casino | Volvin Growth Fund - AR |

Winning Through Monthly Returns Generation

(through aggressive call option writing)

Step - 1 :- In the Equity segment, the Fund invests similar to a diversified mutual fund in stocks of 40-60 listed entities featuring in the 190+ list available in the NSE Futures & Options Segment.

Step - 2 :- To generate returns on a Monthly basis, the fund focuses on covered option writing as a strategy. Monthly options on the stocks in underlying portfolio are sold/ written to generate monthly returns in the derivatives segment. These options are primarily sold on the underlying portfolio in the Equity segment.

Volvin Philosophy - "Volatility"

In the immutable debate of fundamental vs technical, we have to understand these are two sides of a coin, heads marked with value and tails the price - Victor Wayne

Volatility is here to stay There has been a lot of uncertainty about the future primarily due to the shift of the growth from traditional brick & mortar businesses to IoT & new age businesses. Clearly more than 80% growth in the world is due to these new age tech companies and the market capitalisations of these companies have ballooned to huge proportions. Ironically, it is these startups which also carry the highest risk of failure. All these coupled with the aftermath of Covid, reckless money printing by all economies rich or poor, astronomical global debt to GDP ratios, rising geopolitical tensions; it is pretty obvious that Volatility is here to stay for longer than we would want it to.

Active Management

Around 12-15% annualised return is a great return from Equity markets over a long term in Indian perspective. From a universe of around 5000 stocks listed at NSE-BSE, there are around 190+ stocks that also trade in NSE Future & Options Segment.

During the period of one year from 01-Jul-21 to 30-Jun-22, these 195 stocks had an average 52% price variation in their high and lows, the highest variation being 189% and the lowest being 21%. This movement is much higher than the 12-15% annualised return expected from Indian bourses in the long run using passive investment style.